|

| Trading and Profit and Loss Account |

Exchanging Account

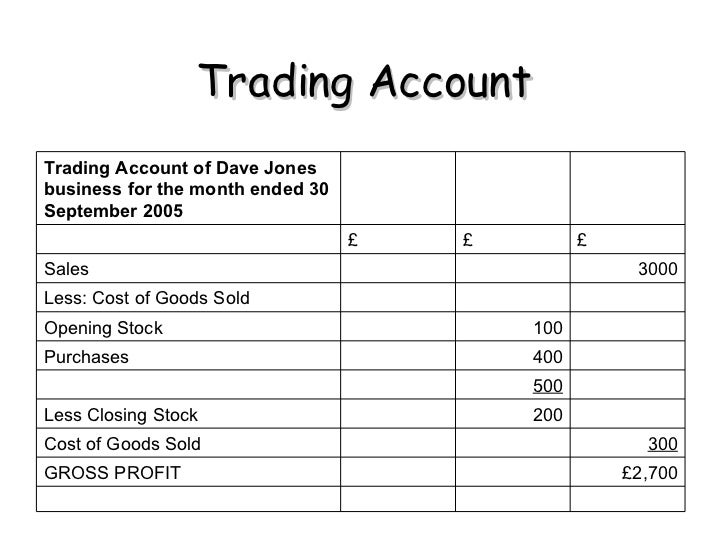

As of now talked about, first area of exchanging and benefit and misfortune account is called exchanging account. The point of getting ready exchanging account is to discover net benefit or gross misfortune while that of second area is to discover net benefit or net misfortune.

Planning of Trading Account

Exchanging account is arranged predominantly to know the gainfulness of the products purchased (or made) sold by the businessperson. The contrast between offering cost and cost of merchandise sold is the,5 gaining of the specialist. Along these lines with the end goal to ascertain the gross procuring, it is important to know:

(a) cost of products sold.

(b) deals.

Add up to deals can be learned from the business record. The expense of products sold is, be that as it may, computed. n request to figure the expense of offers it is important to know its significance. The 'cost of merchandise's incorporates the price tag of the products in addition to costs identifying with buy of products and brining the products to the place of business. With the end goal to compute the expense of merchandise " we ought to deduct from the aggregate expense of products obtained the expense of products close by. We can consider this marvel with the assistance of following equation:

Opening stock + cost of buys - shutting stock = cost of offers

As of now talked about that the motivation behind getting ready exchanging account is to figure the gross benefit of the business. It very well may be portrayed as overabundance of measure of 'Offers' over 'Cost of Sales'. This definition can be clarified as far as following condition:

Net Profit = Sales-Cost of products sold or (Sales + Closing Stock) - (Stock at the outset + Purchases + Direct Expenses)

The opening stock and buys alongside purchasing and bringing costs (coordinate exp.) are recorded the charge side while deals and shutting stock is recorded on the credit side. On the off chance that credit side is Jeater than the charge side the thing that matters is composed on the charge side as gross benefit which is at last recorded on the credit side of benefit and misfortune account. At the point when the charge side surpasses the credit side, the thing that matters is gross misfortune which is recorded at credit side and at last appeared on the charge side of benefit and misfortune account.

Regular Items in a Trading Account:

A) Debit Side

1. Opening Stock. It is the stock which stayed unsold toward the finish of earlier year. It more likely than not been carried into books with the assistance of opening passage; so it generally shows up inside the preliminary equalization. For the most part, it is appeared as first thing at the charge side of exchanging account. Obviously, in the principal year of a business there will be no opening stock.

2. Buys. It is regularly second thing on the charge side of exchanging account. 'Buys' mean aggregate buys i.e. money in addition to credit buys. Any arrival outwards (buys return) ought to be deducted out of buys to discover the net buys. Now and then merchandise are gotten before the significant receipt from the provider. In such a circumstance, on the date of getting ready last records a passage ought to be passed to charge the buys account and to acknowledge the providers' record for the expense of products.

3. Purchasing Expenses. All costs identifying with buy of merchandise are likewise charged in the exchanging account. These incorporate wages, carriage inwards cargo, obligation, clearing charges, dock charges, extract obligation, octroi and import obligation and so on.

4. Assembling Expenses. Such costs are acquired by agents to fabricate or to render the merchandise in saleable condition viz., thought process control, gas fuel, stores, eminences, industrial facility costs, foreman and chief's compensation and so on.

In spite of the fact that assembling costs are entirely to be taken in the assembling account since we are getting ready just exchanging record, costs of this sort may likewise be incorporated into the exchanging account.

(B) Credit Side

1. Deals. Deals mean aggregate deals i.e. money in addition to credit deals. In the event that there are any business restores, these ought to be deducted from deals. So net deals are credited to exchanging account. On the off chance that an advantage of the firm has been sold, it ought not be incorporated into the deals.

2. Shutting Stock. It is the estimation of stock lying unsold in the godown or shop on the last date of bookkeeping period. Typically shutting stock is given outside the preliminary equalization all things considered it is appeared on the credit side of exchanging account. Be that as it may, on the off chance that it is given inside the preliminary equalization, it isn't to be appeared on the credit side of exchanging account yet seems just to be decided sheet as resource. Shutting stock ought to be esteemed at expense or market value whichever is less.

Valuation of Closing Stock

The discover the estimation of shutting stock it is important to make an entire stock or rundown of the considerable number of things in the god claim together with amounts. Based on physical perception the stock records are readied and the estimation of aggregate stock is ascertained based on unit esteem. Along these lines, unmistakably stock-taking involves (I) reviewing, (ii) valuing. Every thing is valued at cost, except if the market cost is lower. Valuing a stock at expense is simple whenever cost stays settled. Be that as it may, costs stay fluctuating; so the valuation of stock is done based on one of numerous valuation strategies.

The readiness of exchanging account encourages the exchange to know the connection between the expenses be brought about and the incomes earned and the dimension of productivity with which activities have been directed. The proportion of gross benefit to deals is exceptionally critical: it is touched base at :

Net Profit X 100/Sales

With the assistance of G.P. proportion he can discover about how productively he is maintaining the business higher the proportion, better will be the effectiveness.

Shutting Entries relating to exchanging Account

For exchanging different records identifying with products and purchasing costs, following shutting sections recorded:

(I) For opening Stock: Debit exchanging record and credit stock record

(ii) For buys: Debit exchanging record and credit buys account, the sum being the et sum in the wake of deducting buys returns.

(iii) For buys returns: Debit buys return record and credit buys account.

(iv) For returns inwards: Debit deals record and credit deals return account

(v) For direct costs: Debit exchanging record and credit coordinate costs accounts separately.

(vi) For deals: Debit deals record and credit exchanging account. We will locate that every one of the records as specified above will be shut except for exchanging account

(vii) For shutting stock: Debit shutting stock record and credit exchanging account After chronicle above sections the exchanging record will be adjusted and contrast of opposite sides found out. On the off chance that credit side is progressively the outcome is gross benefit for which following section is recorded.

(viii) For gross benefit: Debit exchanging record and credit benefit and misfortune account If the outcome is gross misfortune the above passage is switched.

Benefit and Loss Account

The benefit and misfortune account is opened by chronicle the gross benefit (using a loan side) or gross misfortune (charge side).

For winning net benefit a businessperson needs to bring about a lot more costs notwithstanding the immediate costs. Those costs are deducted from benefit (or added to net misfortune), the resultant figure will be net benefit or net misfortune.

The costs which are recorded in benefit and misfortune account are troubled 'roundabout costs'. These be delegated pursues:

Offering and conveyance costs.

These involve following costs:

(a) Salesmen's pay and bonus

(b) Commission to specialists

(c) Freight and carriage on deals

(d) Sales charge

(e) Bad obligations

(f) Advertising

(g) Packing costs

(h) Export obligation

Authoritative Expenses.

These include:

(an) Office compensations and wages

(b) Insurance

(c) Legal costs

(d) Trade costs

(e) Rates and charges

(f) Audit expenses

(g) Insurance

(h) Rent

(I) Printing and stationery

(j) Postage and wires

(k) Bank charges

Money related Expenses

These involve:

(a) Discount permitted

(b) Interest on Capital

(c) Interest on credit

(d) Discount Charges on bill limited

Support, devaluations and Provisions and so on.

These incorporate after costs

(a) Repairs

(b) Depreciation on resources

(c) Provision or hold for dubious obligations

(d) Reserve for rebate on account holders.

Alongside above roundabout costs the charge side of benefit and misfortune account includes different business misfortunes moreover.

On the credit side of benefit and misfortune account the things recorded are:

(a) Discount got

(b) Commission got

(c) Rent got

(d) Interest got

(e) Income from speculations

(f) Profit at a bargain of advantages

(g) Bad obligations recouped

(h) Dividend got

(I) Apprenticeship premium and so forth.

The creator is a building graduate, B.E.(Hons), and is dealing with his very own product advancement firm, HiTech Computer Services, that essentially bargains in bookkeeping, charging and stock control programming for merchants, ventures, business houses, lodgings, healing facilities, restorative stores, daily papers, magazines, oil siphons, car merchants, ware representatives and different business portions, site and web application deveopment for business. The product are accessible both for intranet and web. These product are accessible for download from the site:

No comments:

Post a Comment